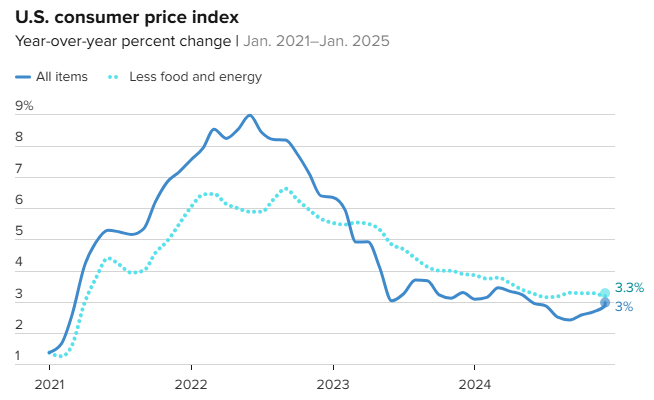

The U.S. consumer price index (CPI) accelerated more than anticipated in January, with a seasonally adjusted monthly increase of 0.5%, pushing the annual inflation rate to 3%. Both figures exceeded Dow Jones estimates of 0.3% and 2.9%, respectively, and marked a 0.1 percentage point rise from December’s annual rate . Core CPI, which excludes volatile food and energy prices, also rose more than expected, increasing 0.4% for the month and 3.3% year-over-year, compared to forecasts of 0.3% and 3.1% .

The hotter-than-expected inflation data has complicated the Federal Reserve’s path forward, with markets now anticipating a prolonged pause on interest rate cuts. Following the CPI report, the probability of a rate cut was pushed out to September, with traders implying only a 70% chance of one cut this year .

Key Drivers of Inflation

Shelter costs remained a significant contributor, rising 0.4% monthly and accounting for about 30% of the overall CPI increase. A key metric within this category, which estimates what homeowners could earn if they rented their homes, increased 0.3% for the month and 4.6% annually. Erik Norland, chief economist at CME Group, noted that higher mortgage rates are pushing more Americans into a rental market with near-record-low vacancy rates, making shelter costs a persistent driver of core inflation .

Food prices also jumped 0.4%, driven largely by a 15.2% surge in egg prices due to ongoing avian flu outbreaks that have forced farmers to cull millions of chickens. This marked the largest monthly increase in egg prices since June 2015 and contributed to two-thirds of the rise in food-at-home prices. Over the past year, egg prices have soared by 53% . Other notable changes included a 2.2% increase in nonalcoholic beverages and declines in fresh vegetables, with tomatoes falling 2% and other vegetables dropping 2.6% .

Energy prices climbed 1.1%, with gasoline prices rising 1.8%. Meanwhile, used cars and trucks saw a 2.2% increase, and motor vehicle insurance costs rose 2%, contributing to an annual increase of 11.8% in that category .

Market Reactions and Fed Outlook

The inflation report sent shockwaves through financial markets. Futures tied to the Dow Jones Industrial Average slid more than 400 points, while bond yields surged, with the 10-year Treasury yield reaching 4.6% . Investors interpreted the data as a sign that the Federal Reserve will likely delay rate cuts, with the odds of a March cut plummeting from 5% to less than 1% .

Fed Chair Jerome Powell had already signaled a cautious approach, telling the Senate Banking Committee that the central bank is in no rush to lower rates as it evaluates inflation progress and monitors the potential impact of President Donald Trump’s proposed tariffs . Trump, however, reiterated his call for rate cuts, posting on Truth Social that “Interest Rates should be lowered, something which would go hand in hand with upcoming Tariffs!!!” .

Broader Economic Implications

The January CPI report highlighted the challenges of taming inflation in a robust economy. While inflation has slowed significantly from its 40-year peak in 2022, it remains above the Fed’s 2% target. The rise in prices also eroded workers’ purchasing power, as the 0.5% increase in CPI entirely offset a 0.5% rise in average hourly earnings .

Economists caution that the current trajectory could keep the Fed on the sidelines for much of the year, maintaining high borrowing costs for consumers and businesses. This contrasts with Trump’s push for lower rates to stimulate economic growth, particularly as his administration prepares to implement new tariffs .

Conclusion

The January CPI report underscores the persistence of inflationary pressures in the U.S. economy, driven by shelter costs, food prices, and energy. With core inflation still elevated and markets adjusting their expectations for Fed policy, the path to achieving the central bank’s 2% target remains uncertain. As policymakers navigate these challenges, the interplay between inflation, interest rates, and economic growth will continue to shape the economic landscape in 2025.